Meeting Topic

How do I position myself in the BEST way to obtain a bank loan? By Zebunisso Alimova Mike Pero Mortgages – Franchise Owner – Wellington

In this article, Zebunisso Alimova – a successful mortgage broker in Wellington – offers her best tips and suggestions for putting yourself in the BEST possible position to obtain a loan.

Consider your own financial ‘habits’ and whether you feel confident that your credit history and current shopping habits won’t unexpectedly ‘bite’ you in the future when you approach a lender.

As you construct your 60-second introduction: 1. read through the article in preparation and then 2. help your fellow group members by sharing one tip YOU have for successfully dealing with lenders or one lesson you have learned the hard way.

………….

Full article

Many of you reading this article may already have a loan – whether a home loan or a business loan. You may have taken one out just recently since interest rates have been so low, or you may have taken it out quite some time ago, when you were on the first rung of the property ladder or when you established your business. Regardless of what position you are currently in, I’ll attempt to keep this article general enough that you will be able to apply the concepts to your situation when the need arises for you to seek your next bank loan.

So, how can you BEST position yourself to obtain a loan via the bank or any other financial institution? Read on…

Often, the first thing that the bank will look at is your credit history and your ability to service (pay back) the amount you wish to borrow. For that, you need to ensure you are aware of the following:

- Good credit history is made up of paying bills on time, having no late payments on your credit card, not going into ‘unarranged’/unexpected overdraft in your accounts, and not having payments ‘bounce’ back. Ensure you are maintaining good account behaviour and staying on top of your bills and payment.

*TIP: if you get paid fortnightly, set your bills to come out fortnightly, the day AFTER your pay. Often people get stung with late payment or overdraft fees when they don’t pay close enough attention to when their bills come out vs when they get paid their wages/salary etc. If you get paid monthly, then change to a monthly billing system, but ensure once again it’s a day or two AFTER you get paid. Lenders don’t tolerate clients who are not taking responsibility for their account behaviour.

- Watch out for new fancy ways of shopping via layby systems. These days, there are so many hooks to entice people to spend money and to have their products now and pay for them later, that its becoming the norm. However, as innocent buyers bite on that hook and obtain multiple laybys, (known as afterpay, humm, etc), they don’t realise how damaging this could be when you are trying to apply for a loan. As the lender goes back and looks at your history of spending for the last three to six months, they check for these type of activities too! If the behaviour is consistent, they must include those services as part of your monthly expenses. *BEWARE – Often, frequent layby activity can be a deal-breaker, as money put aside for layby shopping is resulting in negative servicing ability for the loan you are trying to apply for. So, the good general advice is to avoid layby facilities if you can, especially if you are getting ready to obtain a loan.

- Prepare your financial reports ahead of time and ensure they portray you in the best light – ie: that you are financially viable. Often clients go to the bank with a set of financials that don’t ‘read’ well for the bank. Their gross income or turnover may look fantastic, but when it comes to their NET income after expenses, it may be next to nothing, as all the gross income gets eaten up by various expenses. Certain expenses the bank will add back, such as home office use, depreciation and interest paid on loans. But if the overall financial picture doesn’t look good and there is very little ‘bottom line’ or net income, the bank is unable to use gross income for your loan application.

*TIP: You may need to take a bit longer to prepare yourself to approach a lender in order to get your finances in order. If you CAN wait in order to increase your chances of being approved, you may want to do so.

- Utilise professionals to help you obtain your loan. As a business owner, you may have a long-term picture in mind of where you are heading financially. But it’s important to sit down and crunch some numbers with a trusted adviser. Banks may have a dedicated business manager that looks after a certain group of clients, or you could approach a financial adviser and build a long term relationship there. They will understand your goals, be able to provide you with some recommendations and, just like you take your car for its WOF every year, financial advisers are there to help you monitor the health of your finances, fine-tune your financial choices and help you navigate back onto the right path when things don’t go to plan.

I hope these basic tips will give you a bit more confidence as you look to obtain your next loan, whether small or large. Keep in mind COVID-19 has changed a lot of things in many sectors, and finance hasn’t been left unaffected either. The best thing you can do for yourself is to get in early, get your ducks in a row and engage the professionals so that you get the outcome you want. But remember to be patient at the same time, as application processing is taking longer than usual. On this note, I will leave you with a parting quote from a famous political activist and screenwriter George Bernard Shaw: ‘Success does not consist in never making mistakes but in never making the same one a second time.’

You can find out more about how Zebunisso can help you here: https://www.mikepero.co.nz/zebunisso-alimova

*SIDE NOTE: Zebunisso also appears to be a time management ninja, so if you struggle with ‘the juggle’ ask her how SHE does it!

Next Meeting Topic

How to Read Your Financial Statements By Raelene Rees, Chartered Accountant

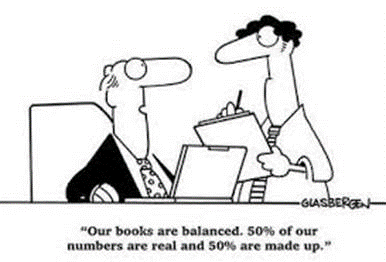

In this article, Raelene Rees – Chartered Accountant and a member of our Venus Management Team – shares vital information with us that can help us understand not only how to read those pesky Financial Reports – the P&L and the Balance Sheet – but also WHY it’s so important to be able to do so.

Can you read your financial statements? If not, what could help you – perhaps further training in this area? A friendly, proactive accountant? Do you think your financials are correct or do you have a ‘feeling’ something’s not right? Do they make logical sense to you? If not, seek out help from your own accountant as a first port of call or from within our network.

As you construct your 60-second intro this time, consider sharing one way you know you can become more financially savvy and empowered in your business (because if you know it will help YOU, it will probably also be helpful to someone else!)

………….

Full article

Firstly, don’t get overwhelmed! There are many, many pages required by legislation but there are really only 2 pages of significance – your Profit & Loss Statement (P&L) and Balance Sheet (also referred to formally as the ‘Statement of Financial Performance’ and ‘Statement of Financial Position’).

The P&L tells you what the profit (or loss) is for the stated period – usually at year end on 31 March.

The Balance Sheet is a snapshot of assets and liabilities of the business as at a certain date – usually 31 March.

The P&L is required for tax purposes and is also a useful tool to see how well, or not, your business is performing. Sometimes outside influences, or things that are outside your control, can affect this – for example Covid 19 and the Christchurch earthquakes. Sometimes these outside influences can be a good thing for business. Often, an unexpected event has a temporary impact and the business will return to a more normal trading pattern after a period of time. For this reason, it’s very useful to compare P&L’s from different years to more accurately view the effect of these fluctuations and not become dependent upon them to continue at the current rate (whether negative or positive).

Another important fact to bear in mind is that after a year of increased profits, a year of increased taxes will follow. I foresee some surprises in this area in 2021!

A P&L will begin with the ‘meaty’ trading area – where sales are matched with the purchase of material necessary for those sales (cost of goods) as well as wages. When you subtract those costs from sales, you’re left with a ‘gross margin’. Gross margin will vary between industries and also types of clientele. For example, The Warehouse will have a much lower gross margin than Harvey Norman, as The Warehouse is relying on thousands of sales of low value items each day.

Next, the P&L will show your ‘overheads’ deducted from the gross margin. ‘Overheads’ include things like advertising, freight, rent, phone, electricity, insurance etc. These may be in the form of direct or indirect expenses. Direct expenses are those items that have a direct effect on turnover like advertising and freight. Indirect expenses are things like insurance or rent – meaning no matter how much you sell, these overheads always remain the same. (One exception is in the instance where you sell so much that you require more space, so rent increases and then your insurance cover needs to increase.)

Finally, the P&L will show ‘depreciation’ being deducted. This is IRD specific rates applied to different assets and is representative of wear and tear as the asset ages and technology improves. NOW you’ll see your ‘net profit’ figure. This is what you pay income tax on. If you are a sole trader, this figure gets included in your personal income tax return. If you trade as a company, it may be split into shareholder salaries and dividends or remain as retained earnings in the company. A good P&L would show an improving net profit position over time, with explanations provided for when it doesn’t go according to plan. A good accountant will indicate when your costs and expenses are out of kilter with expected norms for your industry.

The Balance Sheet shows ‘assets’ which include: stock, debtors/receivables, cash in the bank, plant – computers, vehicles (fixed assets) and goodwill on the purchase of a business. It also shows ‘liabilities’ which include: bank overdraft, creditors/payables, deposits received in advance for work not yet done and loan/hire purchase obligations.

A good balance sheet would have:

- more debtors and stock than creditors

- bank balance within limits bank agreed to and fluctuates regularly

- fixed assets in excess of loans/hire purchase

- reducing debt each year

- shareholders fund account in credit, meaning the business owes you money, not you owing the business money

Regular review of your financial reports allows you to monitor these balances so that they look good for the bank when you require their assistance – during a rough patch OR for expansion.

Being able to read financial statements will ensure you are more in-tune with your business and will help you understand how they will change when different circumstances arise (for example, a large customer doesn’t pay you, so your debtors are high and the bank balance is low). Your bank manager will have more respect for you when you can talk sensibly about the financial state of your business – in fact, you could end up knowing more than them! I believe this knowledge is always good, as it puts you in a more powerful position!

You can learn more about how Raelene helps her clients here: https://www.reesaccounting.co.nz/

Print This Post

Print This Post